Do companies need to pay Switzerland’s church tax?

Unfortunately, yes, companies are required to pay church tax most of the time and across most of Switzerland’s 26 cantons, as per Article Three of the Swiss Constitution.

There are very few exceptions.

If your company has an explicitly religious focus, it may be exempt from church tax.

Another exemption may apply if your company is a partnership. If the owner has left their church, as per the requirements for individuals, the company may no longer be liable.

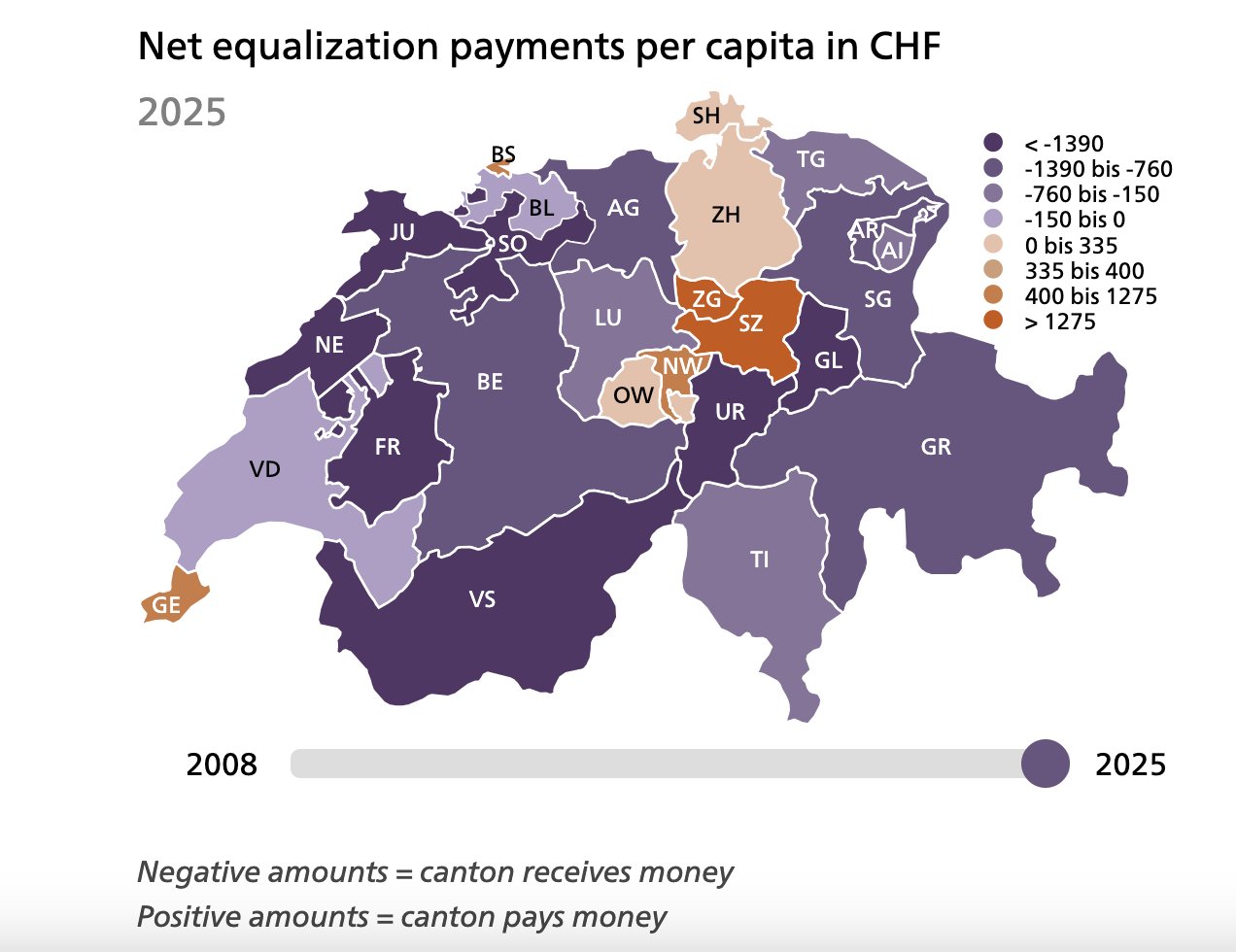

Of course, this depends on cantonal tax laws, which can vary widely across Switzerland. That’s why it’s essential to understand your canton’s tax laws before setting up shop.

READ MORE: Do I have to pay ‘church tax’ in Switzerland?

How much is it?

Church tax is a proportion of cantonal taxes, representing approximately 23.5% of net profits. The exact distribution will vary from canton to canton – and year to year.

Are there cantons where companies are not liable for the church tax?

Some cantons don’t levy church tax on companies.

The good news is that companies based in Geneva, Basel-City, Aargau, Schaffhausen, and Appenzell-Ausserrhoden do not have to pay.

In two other cantons, Ticino and Neuchâtel, the payment of church tax is optional for companies.

Do sole traders and freelancers have to pay?

Not unless the owner, as an individual, has indicated membership in one of the recognised churches in their canton during the registration process—the Swiss Catholic Church, the Roman Catholic Church, the Evangelical Reformed Church, or the Jewish community.

If you’ve already done this, you can leave the church by following a simple procedure, depending on your canton of residence.

This involves sending a registered letter to your parish or synagogue expressing a desire to leave the church. You must send a registered letter stating the same to the cantonal tax office.

Of course, this procedure will vary, so you must determine the exact process for your canton, and remember that the Swiss are sticklers for detail.

Having done this, you will be considered as leaving the church on December 31st of that year, and not be liable for church taxes from that point onward.

READ MORE: OPINION: Why so many Swiss are quitting the church and taking their money with them

How do the Swiss feel about this?

Despite a dramatic drop in the number of Swiss declaring membership in a church over the last five years – some estimates put it at approximately 5 percent – most of Switzerland’s cantons have yet to abolish church taxes on companies, and those referenda that are called on the matter do not succeed.

One reason could be—and so the churches argue—that scrapping the church tax on companies would substantially burden the state and, therefore, the average Swiss taxpayer.

The number of hospitals, aged care facilities, daycares, and schools run by churches—the Catholic church in particular—is cited. Substantive infrastructure costs could be incurred if these facilities were either closed down or taken over by the state.

That’s not to say that abolishing the church tax on companies is not a subject of frequent debate. As recently as this week, a right-of-centre FDP party member, Carlos Reinhard, introduced a motion in Bern’s cantonal parliament to make it voluntary for companies to pay the church tax.

Such a move would place in doubt the local Catholic church’s ability to fund the equivalent of approximately 38 million euros in works. Understandably, the church in the canton has been strenuously campaigning in favour of maintaining the status quo.

Please whitelist us to continue reading.

Please whitelist us to continue reading.

Member comments